Tax season can be a stressful time for business owners, but with the right preparation, it doesn’t have to be overwhelming.

To help you navigate through this period smoothly, we’ve compiled a list of 10 essential steps that every business owner should take to prepare for tax season effectively.

1. Organize Your Financial Records

Start by gathering all necessary financial documents, including income statements, expense receipts, bank statements, and payroll records. Keeping your records organized will save you time and reduce the likelihood of errors when filing your taxes.

2. Review Your Expenses

Take the time to review your business expenses thoroughly. Identify any deductible expenses that can help reduce your taxable income. This includes expenses related to office supplies, equipment, travel, and professional services.

3. Maximize Deductions and Credits

Familiarize yourself with available tax deductions and credits for businesses in your industry. This might include deductions for home office expenses, health insurance premiums, retirement contributions, and research and development expenses.

4. Stay Updated on Tax Law Changes

Tax laws and regulations are subject to change, so it’s essential to stay informed about any updates that may affect your business. Consult with a tax professional or use reliable resources to ensure compliance with current tax laws.

5. File Accurate Quarterly Estimated Taxes

If you’re a sole proprietor, partner, or S-corporation shareholder, you’re generally required to pay quarterly estimated taxes. Review your income and expenses for the year, and make sure you’re making accurate quarterly payments to avoid penalties.

6. Organize Employee and Contractor Information

If you have employees or work with independent contractors, ensure that you have accurate records of their earnings and tax withholdings. This includes W-2 forms for employees and 1099-MISC forms for contractors.

7. Review Your Business Structure

Consider whether your current business structure is still the most advantageous from a tax perspective. Depending on your business’s growth and changes in tax laws, it may be beneficial to reevaluate your structure and make any necessary adjustments.

8. Plan for Retirement Contributions

Explore retirement savings options for small business owners, such as SEP-IRAs, SIMPLE IRAs, or solo 401(k) plans. Making contributions to retirement accounts can not only help you save for the future but also provide valuable tax benefits.

9. Utilize Accounting Software

Invest in reliable accounting software to streamline your bookkeeping processes and generate accurate financial reports. Many accounting software solutions offer features specifically designed to simplify tax preparation for businesses.

10. Consult with a Tax Professional

Finally, don’t hesitate to seek guidance from a qualified tax professional. A certified public accountant (CPA) or tax advisor can provide personalized advice, help you identify additional tax-saving opportunities, and ensure compliance with all tax requirements.

By following these steps, you can proactively prepare your business for tax season and potentially minimize your tax liability. Remember, early preparation is key to avoiding last-minute stress and maximizing your tax savings.

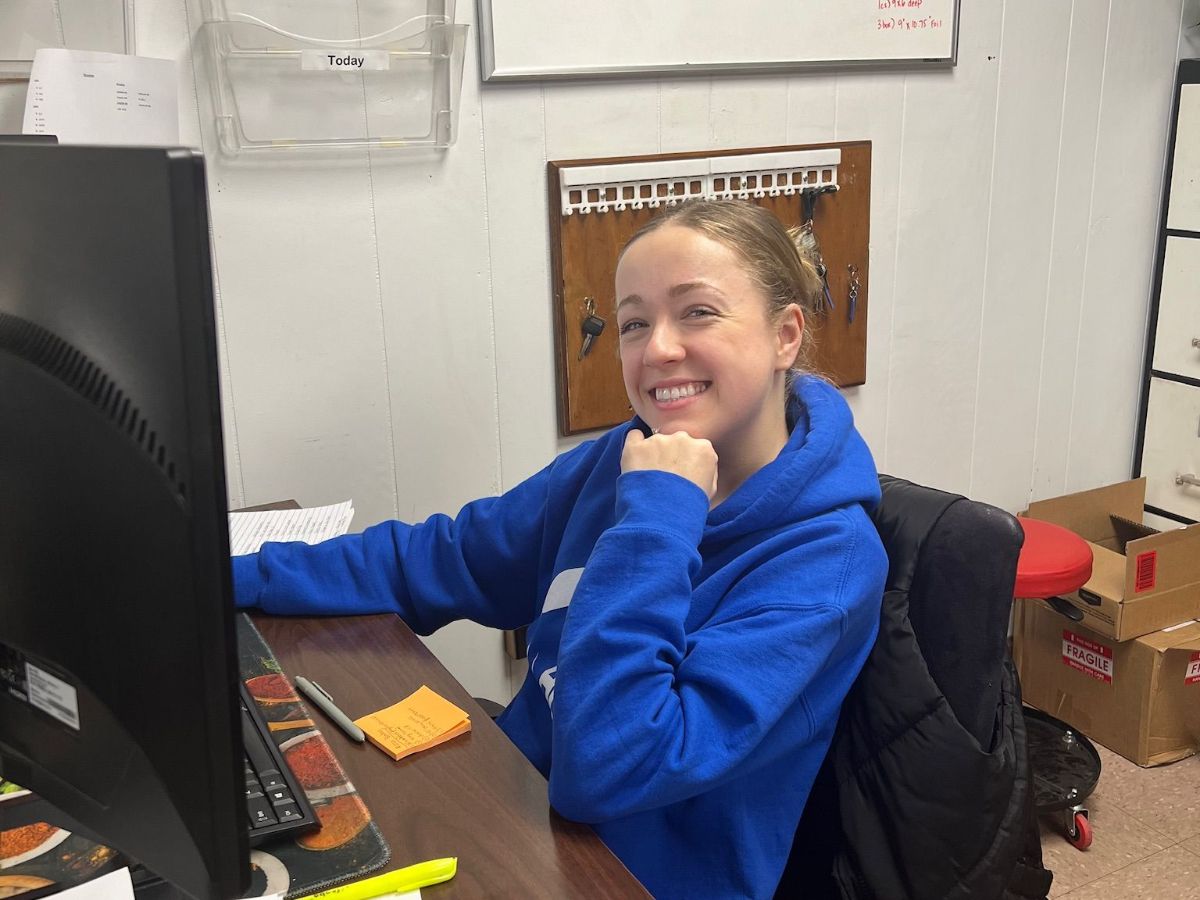

Meet Sara!

Sara is the newest addition to the APS team. She was recently hired as an Office Administrator, so if you call APS headquarters, you may speak to Sara. We’re excited to have her as part of the APS family. Here are some fun facts about Sara:

College basketball fans, get ready for a fun giveaway from APS!

We are creating an APS team for March Madness and the bracket winner will receive a $250 Visa gift card! Stay tuned for how to play and win!

Make sure you’re following us on social media (see below) so you don’t miss it!